IPL Auctions - Market Dynamics Series Part 3 - Players as Resources

Moving on in this series where I discuss the market dynamics of the IPL auction, I want to move on to the subject of looking at players and their roles as resources with fluctuating levels of supply and demand.

A player pool of finite resources

Very good players, particularly very good domestic players (the same in every league) are a finite resource - there are only a certain amount of them to go around.

The IPL’s expansion to 10 teams has put even more pressure on these finite resources. Let’s say there were 30 very good domestic players in an 8 team league - that’s 3.75 per team on average. This average now drops to 3 per team on average in a 10 team league.

So, using this example, each team on average has 0.75 fewer very good domestic players than they would have done before the 10-team expansion ahead of the 2022 mega auction. This group, when you look at it in terms of supply, has stayed constant (30 players) but the demand (10 teams as opposed to 8) has risen.

In this supply and demand scenario, prices should rise for this group. Throw in the increased auction budget for teams too, and you see why certain players are going to be sought-after at auction. Even looking at the overseas market, you can see why Pat Cummins and Mitchell Starc were able to command such high prices at the last mini-auction - demand for them out-stripped supply.

Retention values will have big implications on strategy

It will also be fascinating to see how the retention values for players change ahead of the 2025 mega auction compared to 2022. For example, a player retained for 12 Crore in 2022 should now be worth more in 2025, because demand is higher and the auction purse for teams is also bigger. There’s more demand, and more ability to pay for it.

So, if the IPL organisers keep the retention brackets the same as in 2022, some teams with good retention options could be getting bargains in the marketplace. In this situation, teams would be smart to retain as many players as possible because the retention values are very likely to be less than open market value.

However, if the retention brackets are higher than in 2022, there will be a point where a player no longer becomes worth it. For example, if organisers see the cost of Cummins and Starc in 2024 and decide that 25 Crore is the benchmark price for world-class players, a number of players will expect to be first retention for 25 Crore.

Actually, very few, if any, players are worth paying 25% of your entire budget for - simply because the implications of being constrained due to that spending is not in line with the benefit of signing one player. You could maybe make a case for Jasprit Bumrah being worth it, but that would be it.

I would expect teams to act differently though, given the emotional effects of their decisions. Could the likes of Hardik Pandya, Virat Kohli and KL Rahul decide they want first retention at 25 Crore? If so, their teams looking to retain them are potentially overpaying.

Big prices for anchor/rotator batters shows market inefficiencies

At this point, we haven’t even talked about skillsets yet, and that some skillsets have more plentiful resources than others. I’ve written a lot about how many anchor/rotator domestic batters there were in the IPL in previous years, and in some cases there was an oversupply of these particular players.

This, in theory, meant that some overseas players with that dynamic (e.g. Steve Smith, Kane Williamson, Joe Root) shouldn’t have been of much interest to teams when the oversupply of domestic anchors/rotators, because you can get a domestic player who is 85-90% as good for a very low price, as opposed to often paying big money for an overseas batter who is also taking up an overseas slot.

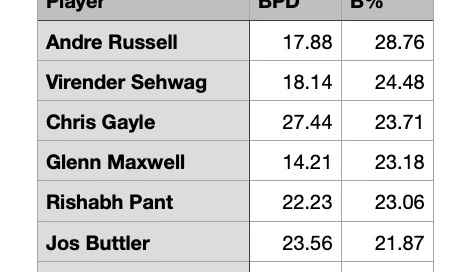

For example, looking at the top 10 highest boundary % IPL batters facing 500+ balls between the start of 2010 and the end of 2019, only two were domestic - Sehwag and Pant:-

Conversely, the list of the 10 lowest boundary % batters in the same sample contained six domestic players:-

10 of the 20 batters with the lowest boundary % of the sample size were domestic, but some overseas batters - Ross Taylor, David Hussey, George Bailey, Steve Smith and Mike Hussey - also featured in the 20 batters with the lowest boundary % despite only having one major skillset. At least the likes of Angelo Mathews and Jacques Kallis were all-rounders.

This also gives great insight into the historical inefficiency of the IPL auction market - anchor batters were picked up, often at decent cost, despite it being a plentiful skillset for domestic batters already.

Domestic batters have evolved into better hitters

Fast-forwarding to more recent times, there has been a change in the aggression levels of domestic players. Looking at IPL batters facing 150+ balls this season, five of the top 10 boundary percentage players are domestic, and 12 of the top 20.

What does this mean for market dynamics? Although there are still some domestic anchors/rotators (for example Gaikwad, Sai Sudharsan, KL Rahul, Jadeja, Badoni and Rahane), there is basically a complete reversal in the domestic batter profile - previously they were mostly anchors/rotators and now they’re hitters and the domestic batting player pool is, generally speaking, evolving apace with the continual demands of the format.

So, high-intent domestic batters are now a more plentiful resource in the marketplace than they was previously the case. Supply has gone up, while demand will always be strong. The price on them should fall slightly.

Conversely, the market price for anchor/rotator batters should also fall, because there should be, in an efficient market, lower demand. Look at it like this - when there are so many high intent domestic batters breaking through, and no doubt more to come as the next few years progress, demand for players without notable big-hitting in their locker should drop.

So, you’re probably thinking “hold on, he’s saying that the price should drop for domestic hitters (due to higher supply) and he’s saying that the price should drop for domestic anchors (due to lower demand) as well, and that makes no sense”, but I’ll refer to part two of this series which can be read here.

In that, I spoke about how batters are overvalued in the market, costing around double the cost of bowlers in terms of lakh cost per ball match involvement. So, there needs to be a market correction in batter price, full-stop, for both hitters and anchors.

Scarcity of resources should push price of elite bowlers upwards

Conversely, the price of domestic pacers may correct the other way - upwards. Looking at bowlers who have bowled 30+ overs so far in this tournament, just five of the 36 bowlers (Bumrah, Narine, Jadeja, Brar, Axar Patel) have an economy rate below eight runs per over conceded. 15 of the 36 have economy rates below nine runs per over.

Of those 15, 11 are domestic and just four are overseas (Narine, Noor Ahmad, Boult, Rabada), and if we take this as a benchmark of being a good IPL bowler (in terms of economy rates), there are only 1.5 good domestic bowlers per team in a 10-team tournament.

Given that a team needs to field five bowlers in a match at a bare minimum, we can see a clear shortage in supply of high-quality bowlers. Not only this, but a good bulk of the 15 bowlers with economy below nine runs per over will be retained by their franchises ahead of the mega auction - there may only be five or so of these players available for teams to bid on.

Even the next tier of players could well be in real demand in terms of retention and in the auction. An efficient IPL auction market should be prioritizing the best bowlers in the marketplace, as opposed to batters.

Genuine all-rounders continue to be a very rare commodity

Of the 36 bowlers who have bowled more than 30 overs in the tournament, only Sunil Narine, Axar Patel, Sam Curran and Hardik Pandya can be described as being close to genuine all-rounders. Maybe Ravindra Jadeja, but he seems to have dropped off in terms of boundary-hitting abilities. The likes of Harpreet Bar, Rashid Khan, R Ashwin and Harshal Patel aren’t all rounders in the truest sense (due to low average balls faced with the bat) and should be classified as frontline bowlers who can bat.

Therefore, genuine all-rounders are a real scarcity of resource. It’s not a surprise that in recent years, when players such as Sam Curran or Chris Morris come into a mini auction, bidding goes wild and record prices, or as good as, are witnessed. Every team would want a genuine all-rounder in their squad (even teams with one already), but there might only be one to bid on, and that is likely to be from the overseas market. A world class domestic genuine all-rounder available in a mini auction could break all pricing records.

Low supply and high demand create this market dynamic, and there could even be an argument to suggest that a genuine all-rounder might be financially better off skipping a mega auction and then registering for the first mini auction afterwards, ahead of year two of the auction cycle. This way, they’d ensure very low supply with continuing high demand.

Overseas spinners may finally get more opportunities in the next auction cycle

Briefly, to conclude, a look at the overseas market. One-skilled overseas batters (when I say one-skilled, I mean they don’t bowl or keep) tend not to be expensive at auction, because of an oversupply of these good overseas batters. High prices for the likes of Harry Brook in the past tend to be an exception, as opposed to the rule.

The other rule of thumb which people have often referred to is a lack of demand for overseas spinners. Generally, IPL teams have been content with sourcing these from the domestic market given relatively decent supply.

12 spinners (9 domestic, 3 overseas) have bowled 30+ overs in the tournament this year so far, which at first glance seems like a decent amount. However, Narine, Jadeja, Ashwin, Chahal and Chawla are well into their 30s now and will not last forever. We could see a real drop in supply in high quality spinners during the next auction cycle, unless new stars are developed.

In theory, that could open up the market to some more overseas spinners - it will be fascinating to see if the teams react to this potential reduction in supply by giving greater opportunities to overseas spinners in the next auction cycle.

Anyone interested in discussing how I can help their team with strategic management and data-driven analysis, or contribute to any media work, can get in touch at sportsanalyticsadvantage@gmail.com.