Did my model accurately predict sale prices for players? A lot of people were keen to find out, so here’s some detailed analysis…

In short - yes. Not only was the model very accurate, but it also surpassed previous versions from other IPL seasons. At this point again I want to make it clear to new readers that my IPL player valuations have absolutely nothing to do with how good or bad I think a player is, or what I think a player will or won’t sell for, or what I think their fair market value is.

It is simply ‘wisdom of the crowd’.

Out of 143 players who were priced in the mode that eventually soldl, 109 were sold within 2 Crore of their modelled expected sale price (76.2% of players). 80 players were sold within 1 Crore of their modelled expected sale price (55.9% of players).

Looking at those players with big price deviations, 27/34 (79.4%) of the players outside the 2 Crore range were listed as high or very high price volatility - essentially, the crowd was split on the value of those 27 players values even before the auction started.

Continuing, 25/31 (80.6%) of players with medium expected price volatility sold within 2 Crore of their expected price, and 20/31 (64.5%) of medium volatility players sold within 1 Crore of their expected price.

The model was extremely accurate on expected low volatility players. Only 2/29 with low expected price volatility (6.9%) sold for 1 Crore or more than expected. One was Jamie Overton (who sold at base price but had low sale expectations) and the other was Priyansh Anya who benefited from ultra-late recency bias after scoring a century in the Syed Mushtaq Ali Trophy after the ‘crowd’ had given their opinions.

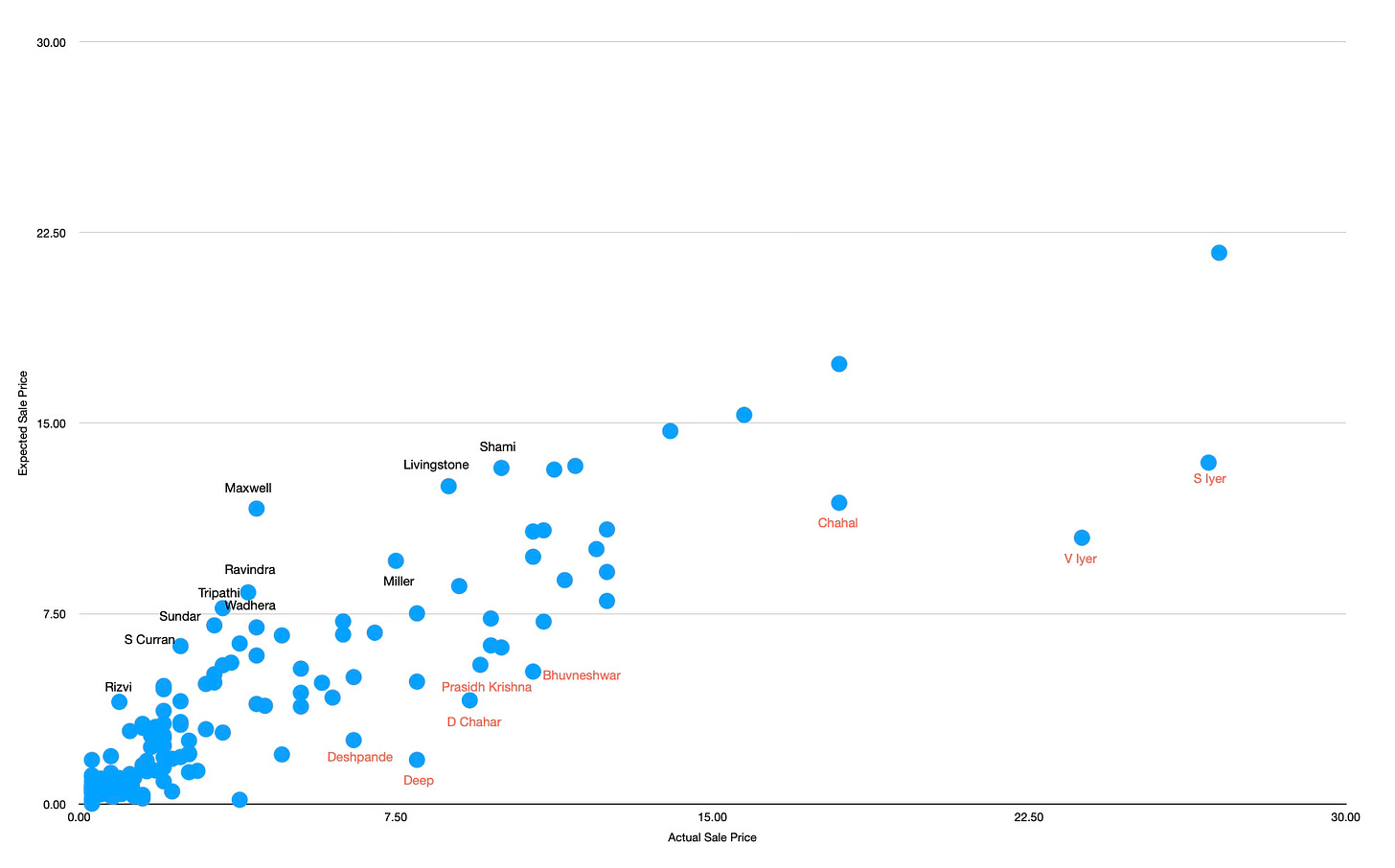

Here’s a look at the comparisons between actual sale price and expected sale price for players (players in black type sold for considerably less than expected and players in red type sold for considerably more than expected):

Only two players with a modelled expected sale price of 3 Crore or more were unsold - David Warner and Jonny Bairstow. This was the same number as in the 2022 mega auction from similar but slightly less advanced methodology.

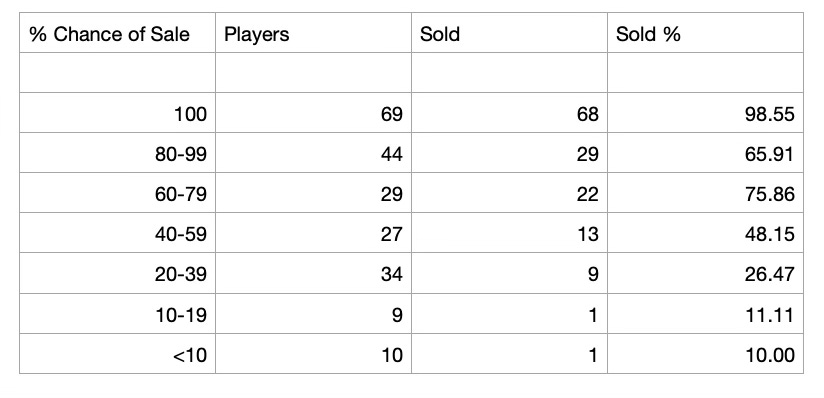

A look at percentage of sale expectations is interesting. Only one player which the model said had a 100% chance of selling went unsold, and that player was Anmolpreet Singh, who had a low expected sale price anyway. Here’s a look at the breakdown of sales by modelled percentage chance of sale brackets:

I think this is pretty accurate overall, although the 80-99% chance of sale bracket was a little disappointing. Players who went unsold in this bracket were Prithvi Shaw, Kartik Thani, Dewald Brevis, Jonny Bairstow, Daryl Mitchell, Nandre Burger, David Warner, Sikandar Raza, Sanvir Singh, Suyash Prabhudessai, Mayank Agarwal, Naveen ul Haq, Shardul Thakur, Yash Dhull and Piyush Chawla.

Probably a decent list of names who might be in contention for replacement player roles.

One final piece of analysis which a few people asked me to look at focuses on total squad value, which I interpreted as total retention spending plus total pre-auction modelled expected sale value of the players they eventually purchased.

This produced some fascinating results:

Sunrisers Hyderabad, by some distance, have the most valuable squad when looking at this approach. Chennai Super Kings and Delhi Capitals followed closely behind.

Conversely, teams like Rajasthan Royals and Punjab Kings - several franchises which there seems to be a general consensus that had poor auctions - have the least valuable squads. RR were strangely inactive in large parts of the auction while PBKS overpaid for a number of players according to my model - and were a team who contributed to a number of outliers between modelled expected price and actual price at auction.

Anyone interested in discussing how I can help their team with strategic management and data-driven analysis can get in touch at sportsanalyticsadvantage@gmail.com.